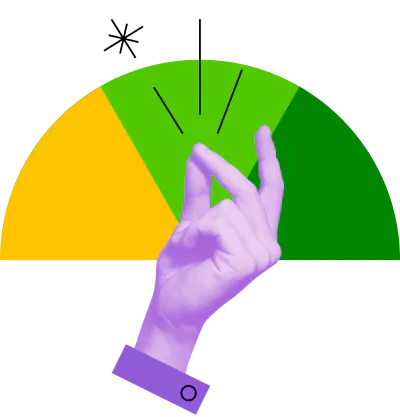

- Get your actual FICO Score now. Find the right plan for you. Your FICO Score is estimated to be between: Understanding your FICO Score. Score ratings can be: Poor, Fair, Good, Very Good or Exceptional, defined by the ranges in the chart below. Exceptional 800-850. Very Good 740-799.

- Free Credit Score and Analysis Tool. We are distributing access through installation military financial educators and counselors in the military Personal Financial Management Program (PFMP). To use the tool, your first step is to contact a military financial educator (sometimes called a 'PFM or PFC') at your nearest PFMP Office (which is.

Having a Good Credit Score. Credit scores range from 300 to 850. Scores of 750 and over are considered best and are most likely to get you prime rates. Scores of under 500 can mean you get rejected for credit line increases and loans. Your credit score is most often used when you apply for financing, such as a new loan or credit card.

Additional Information

Improving Your Credit Rating

Even if you have not fallen on hard times, you need to know about your credit rating and how to make sure it accurately reflects your credit history. Negative information in your credit report can adversely affect your ability to get credit or get the best loan interest rates. Information about your credit history is collected by credit bureaus, who then sell this information to lenders and others who need it in connection with loans, getting a job, or other financial applications you may make. You must authorize the credit bureaus to give out this information by signing a waiver on an application you make. There are three primary credit bureaus in the United States who collect and disseminate this information: Equifax, Experian, and TransUnion. You should obtain a copy of your credit report from each of these bureaus at least once a year to verify that the information they have is correct.

You build your credit report every time you apply for and use credit. Creditors send information about your credit history with them to one or more of the credit bureaus. Most of the information is accurate and timely, but sometimes it is not. When you miss loan payments, pay late, default on a loan, or have a debt dropped (called a charge-off), that information goes on your credit report.

Click here for full articleWhat Is Your FICO Score and Why Is It Important?

Just because you want to buy a home doesn't mean that a lender is eager to loan you money. Lenders look at your past history in handling your finances, which is where the FICO score comes in. By the end of this article, you will be able to identify a good FICO score and how it was determined.

The FICO score boils your credit history down to a three-digit number that instantly tells a lender whether you are creditworthy. This score dictates what terms—if any—you will be offered in a mortgage. Pioneered by the Fair, Isaac Corporation, this score and similar ones used by other credit reporting services rely on the following factors:

Click here for full article

How Lenders Rate Creditworthiness

Amex Credit Score Tool

Lenders must evaluate the risks of lending money to others. In commercial lending, creditors generally follow the same principles to evaluate a borrower's creditworthiness.

A creditor usually looks at three factors known as the 'three Cs': capacity, capital, and character.

Clearscore

- Capacity. The present and future ability to meet your financial obligations. Some of the areas examined would be your work history and the amount of debt that you already owe.

- Capital. Savings and other assets that could be used as collateral for loans. Even if you are not required to post collateral, many creditors express a preference that you have assets other than income that could be used to repay a loan.

- Character. This boils down to trustworthiness, promptness in paying your existing bills and other debts, and your credit history.